For the second year running, demand for tomato products from the United States hit record highs, according to the June 2013 stock report from the California League of Food Processors.

For the second year running, demand for tomato products from the United States hit record highs, according to the June 2013 stock report from the California League of Food Processors.

For the 2012/13 marketing year ending June 1, demand was 13.510 million fresh equivalent tons beating last year’s record disappearance by 3.4%.

Driven by export sales, the increased movement has outstripped domestic production for the last two years and eaten into a surplus which has sat on the shelves since the record‐setting 2009 season.

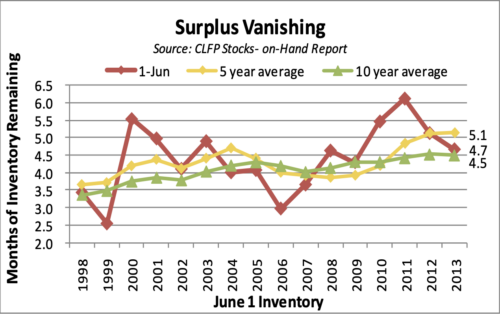

The graph below shows the months of carryover inventory available at the end of the marketing year (June 1), plus the 5 and 10 year averages. The green 10 year average line shows that packers aim for about four months of inventory going into the new season, since customers still need shipments before everything is packed.

After reaching an excessive high of 6.1 months of supply going into the 2011 season, carryover has fallen to more reasonable levels. In 2012, California packed its second-largest crop ever, but carryover inventories are at normal levels going into the 2013 season due to record demand.

This vanishing surplus and normalizing of inventories, even in high production years, reflects the strength of the U.S. industry.

After months of negotiation, the growers’ association and packers agreed in April to a 1.6% increase in the price of tomatoes for 2013. Growers will receive $70.50 per ton, the second highest price recorded. The record price was set in 2009 at $80 per ton.

Morning Star Newsletter now distributed electronically

As a reminder, Morning Star is now distributing our newsletters electronically using an email distribution vendor called Mailchimp. Your e-version will now include informative Morning Star videos and highlights. Depending on your company's firewall, these emails may initially be directed to you spam folder.