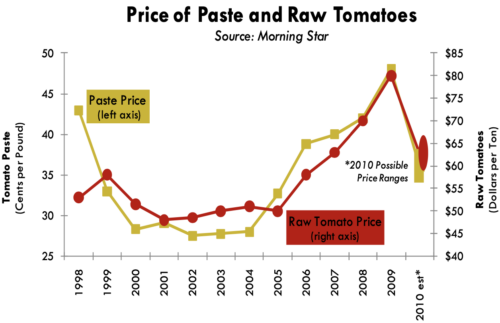

Since tomatoes make up most of tomato paste’s processing cost, bulk tomato paste prices follow the field price closely. This year the raw tomato price will tumble 20‐25% and reduce paste prices proportionately. Opening offers for new pack 31% NTSS tomato paste range from 36‐38¢ per pound — below last year’s open‐ ing price of 48¢.

Since tomatoes make up most of tomato paste’s processing cost, bulk tomato paste prices follow the field price closely. This year the raw tomato price will tumble 20‐25% and reduce paste prices proportionately. Opening offers for new pack 31% NTSS tomato paste range from 36‐38¢ per pound — below last year’s open‐ ing price of 48¢.

DEMAND DRIVES PACK PLAN

Last season, the industry planned for a record‐breaking pack. High paste prices, driven by chronically tight global supplies, encouraged processors to package every available tomato.

The nearly flawless weather conditions provided packers with an extraordinary volume of tomatoes, definitely more tons than expected and probably more than they really needed.

As a result, the worldwide mar‐ ket has swung from tight supplies to a surplus in a single season.

Yet it’s important to remember that growing demand, which caused packers to shoot for a record pack in 2009, still exists and could eat into the surplus faster than expected.

ABOVE AVERAGE DEMAND

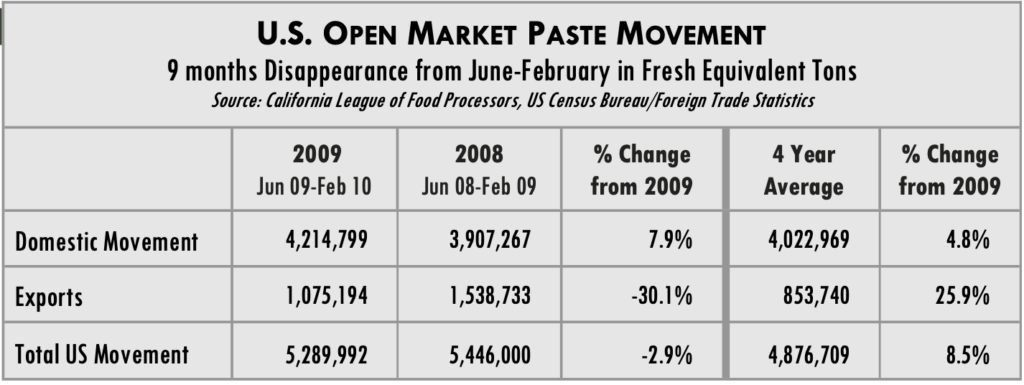

Tomato stocks in the United States disappeared faster than average for the first 9 months of the 2009 marketing year. US packers moved nearly 10% more stocks from June 2009 ‐ February 2010 than the average of the same period over the last four years, according to the California League of Food Processors.

Let’s narrow the viewpoint to focus on US open market tomato paste— “Paste for Sale” per CLFP.

Demand for paste in the US has improved since last year. As shown in the accompanying table, domestic paste movement (total movement less exports) is up 7.9% over the same 9 month period last year.

Because of strong demand inside the US, total movement (including exports) has only fallen 2.9% from the last period’s record high. The decline stems from a predicted drop in exports. Ample global stocks and a stronger dol‐ lar have weakened US export opportunities. Despite the recent decline, paste exports are still nearly 26% above the four year average for the period.

High consumption and changing subsidies in the European Union should keep US exports at high volumes experienced since 2007.

In its April issue, Tomato News revealed that EU tomato consumption climbed sharply after

the 2007 season. Tomato usage grew approximately 30% and appears to be holding at new highs.

The EU is in the final season of decoupling its tomato subsidy program. Analysts speculate the 2011 field prices of European tomatoes will spike as they did when decoupling began in 2008. High costs should decrease EU production and increase imports.

Morning Star Newsletter now distributed electronically

As a reminder, Morning Star is now distributing our newsletters electronically using an email distribution vendor called Mailchimp. Your e-version will now include informative Morning Star videos and highlights. Depending on your company's firewall, these emails may initially be directed to you spam folder.