2021 crop expected to meet initial intentions of 38.8 million mT

As with the start of every new season, weather tends to impact initial harvests differently around the globe. Drought may be one region’s challenge while rain or hail may be another’s – something the major processing countries are wrestling with daily. As California fights to withstand the perils of drought, we see similar regions globally share that challenge.

As with the start of every new season, weather tends to impact initial harvests differently around the globe. Drought may be one region’s challenge while rain or hail may be another’s – something the major processing countries are wrestling with daily. As California fights to withstand the perils of drought, we see similar regions globally share that challenge.

In Portugal, heat pummeled the region, reaching as high as 40° Celsius (104° F) but the cooling-off period that followed may have delayed the harvest of tomatoes that were ready for processing. Portugal remains optimistic for a 1.4 million mT production.

Spanish processors in Andalusia began in early July and were at full processing capacity by the second week. Processing in Extremadura, due to rain and lower temperatures in June, is starting later and will be at full processing capacity by the month’s end. Spain has kept their original forecast of 3.1 million mT.

Northern Italy has planted 2.3% fewer hectares this season, suggesting production may be closer to 2.75 million mT rather than the 2.8 forecast. Their main crops began production at the end of July and are expected to reach capacity by early August. While their weather has been good overall, some late-season storms caused some bacterial diseases in small areas.

Southern Italy began processing in late July, with satellite monitoring showing a 14.12% increase in hectares planted. Southern Italy still maintains its original 2.7 million mT. With low yields early in the season, growers and operators are hoping for better conditions and yields in the coming weeks. Heavy rains in late July caused some flooding but limited damage was sustained to the tomato crops.

France has struggled to have good weather. Southeastern France has had cold temperatures, but both main factories began production at the end of July. In the Southwest, however, the weather has caused harvesting to be delayed by weeks. Despite the weather difficulties, France maintains its original forecast.

Tunisia has harvested approximately 17,000 hectares of tomatoes and 568,000 tomatoes have been processed amongst their 24 factories. Their forecast stands at 1 million tonnes. Smaller growing regions, such as Egypt, Greece, Hungary, and Ukraine all have maintained their tonnage expectations.

As we head into the heart of the tomato season, processors will be looking to maximize yields despite the ever-changing nature of the growing conditions.

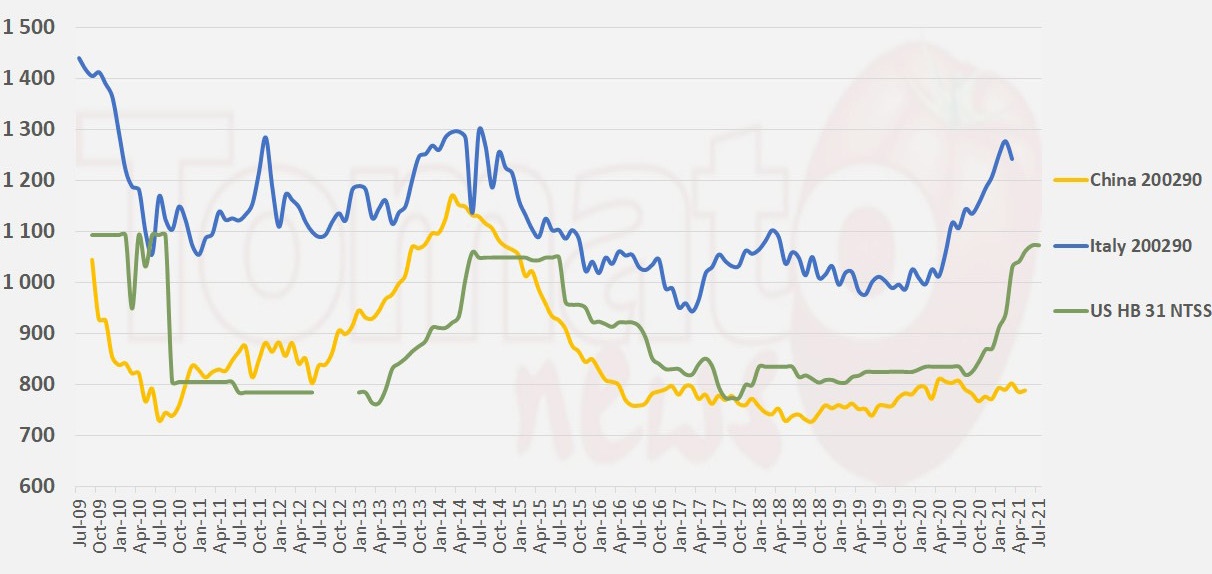

One particular area to pay attention to as processors progress through the season is the price of tomato paste in different regions. Around the world, we are seeing a steady increase in prices. Contributing factors include exchange rates, inventories, and raw tomato costs and availability. The US, a particularly influential region, has increased prices for hot break tomato paste by around 30% in the last year. Italy, another major player on the international circuit, has seen increases in the last year as well.

###

Morning Star Newsletter now distributed electronically

As a reminder, Morning Star is now distributing our newsletters electronically using an email distribution vendor called Mailchimp. Your e-version will now include informative Morning Star videos and highlights. Depending on your company's firewall, these emails may initially be directed to you spam folder.