Navigating Crop and Water Dynamics

By: Erik Sunderbruch

Competing Crop Trends: Staying Ahead of Shifting Economics

Returns from competing crops continue to influence acreage decisions in California, directly affecting tomato supply and pricing. At Morning Star, we monitor these markets closely—not only to mitigate risks to our supply chain but also to uncover opportunities to strengthen grower relationships and reinforce the long-term competitiveness of California tomatoes.

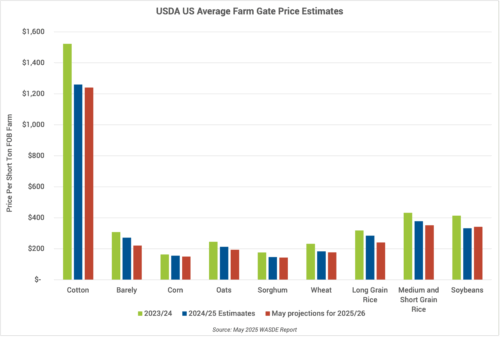

Globally, the grain markets remain well supplied. Corn production is set to increase, driven by a projected record U.S. crop and strong yields in Argentina, Brazil, and Ukraine. Demand remains solid, especially in Mexico and the European Union. Wheat is also expected to reach record production, consumption, and trade volumes. Increases in output from the EU and India are helping offset regional declines, and ending stocks are poised to rise. Similarly, rice production and consumption are on track for new highs, led by South and Southeast Asia, with global trade slightly increasing and stocks holding steady.

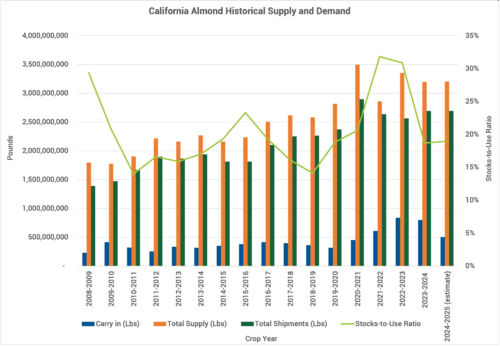

In California, market conditions across major crops are mixed. Almonds are rebounding after several years of oversupply. Elevated orchard removals and leaner ending stocks have improved pricing, bringing profitability back for many producers. With bearing acreage now plateauing, the market appears to be entering a healthier supply-demand balance.

Meanwhile, alfalfa and silage prices remain well below their levels of two years ago. Although signs suggest prices may have bottomed out, current levels are still not profitable for many growers. In the Central Valley, continued oversupply in the bulk wine grape segment is driving further vineyard removals, reflecting shifts in consumer behavior and ongoing efforts to realign supply with demand.

These developments underscore the need to remain agile. As crop economics evolve, Morning Star remains committed to collaborating with our growers, leveraging real-time intelligence, and proactively adjusting strategies to ensure a consistent, high-quality tomato supply at competitive prices.

SGMA and the Water Future: Proactive Planning in a Shifting Landscape

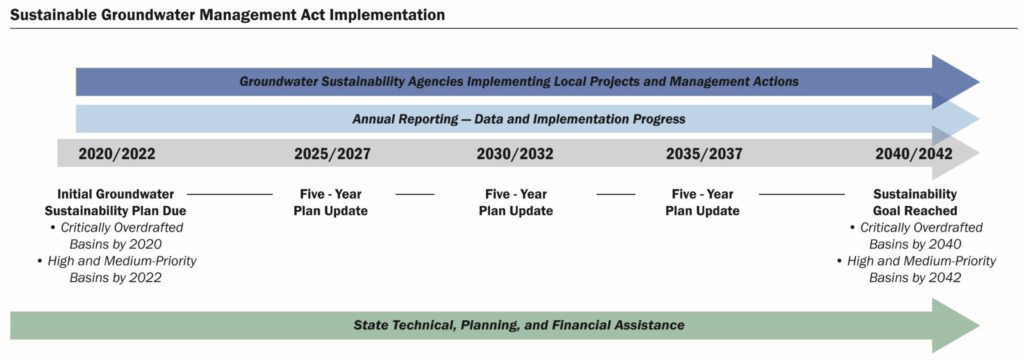

More than a decade since the passage of the Sustainable Groundwater Management Act (SGMA), California is beginning to see real impacts on agricultural operations. Groundwater Sustainability Agencies (GSAs) have been formed statewide, and nearly all have submitted required Groundwater Sustainability Plans (GSPs). While most plans have been approved, a small number were deemed inadequate and are now in various stages of revision—and one GSA has been placed under formal probation by the state.

These GSPs reflect diverse regional strategies for achieving groundwater sustainability by 2040. Approaches include limiting pumping, implementing tiered water pricing, and increasing recharge through enhanced groundwater storage or surface water infrastructure. As SGMA implementation accelerates, the Central Valley is expected to see a growing divide between regions with ample surface water access—which will likely maintain higher production potential—and areas with little or no surface water, which may face long-term constraints.

There is also growing concern that the policy’s burdens will fall unevenly. Larger operations may have the capital, scale, and flexibility to adapt quickly, while smaller farms could struggle to remain viable in the face of increased regulatory and operational complexity.

At Morning Star, we view water access as a strategic issue central to agricultural resilience. We actively track SGMA developments to understand their effects on our grower network. Just as we monitor market shifts in competing crops, we evaluate regulatory trends to ensure we’re aligned with regions and partners best positioned for long-term success.

To that end, we are strengthening our grower portfolio in areas where groundwater and surface water conditions are more favorable. By focusing our relationships in resilient growing regions, we are securing the long-term availability of high-quality tomatoes and helping build a sustainable supply system that can weather regulatory and environmental pressures alike.

###

Morning Star Newsletter now distributed electronically

As a reminder, Morning Star is now distributing our newsletters electronically using an email distribution vendor called Mailchimp. Your e-version will now include informative Morning Star videos and highlights. Depending on your company’s firewall, these emails may initially be directed to you spam folder.