Water Planning, Crop Protection, and Market Awareness Guide the 2026 Season

Contributing Writers: Ron Dalforno, Erik Sunderbruch

As the 2025 processing tomato season comes to a close, results exceeded expectations across both yield and quality. Yields finished approximately 10% above contract on conventional acres and 15% above contract on organic acres, setting a new benchmark for productivity. Importantly, quality matched volume, with the crop delivering excellent color and solids – reinforcing the strength and reliability of California supply.

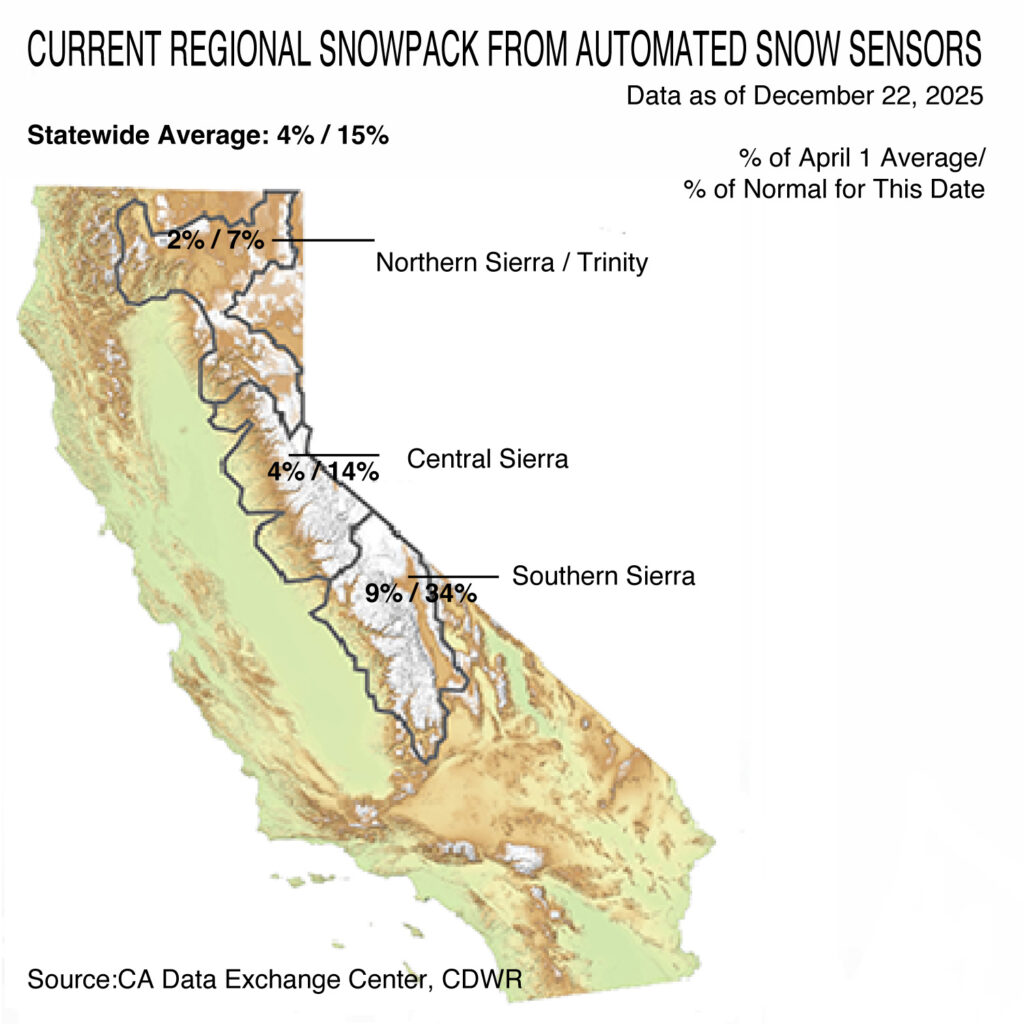

Looking ahead to the 2026 crop year, water remains the primary variable shaping planning discussions. California is currently under a weak La Niña pattern, which typically tilts toward drier conditions across the southern half of the state, including much of the Central Valley. Early storms last fall helped stabilize reservoir levels, with statewide storage sitting just above the long-term average; however, Sierra snowpack is tracking well below normal. In response, the State Water Project has announced an initial 10% allocation for 2026 while agencies await additional precipitation during the critical January-March period. Temperatures are expected to run warmer than average overall, with periods of valley fog and cold nights but no strong indication of extended freeze risk. For processing tomatoes, the winter outlook is less about immediate weather threats and more about how much additional precipitation can be captured to support surface-water deliveries heading into the growing season.

Across California agriculture more broadly, many competing crops continue to face economic headwinds from lower commodity prices, elevated production costs, and compressed margins. Corn markets remain under pressure following record US production, despite strong export demand, contributing to lower dairy feed costs. Pima cotton supplies continue to exceed demand even with reduced acreage, limiting near-term price recovery. California rough rice prices are improving from depressed levels in 2024 but are unlikely to return to prior highs in the 2025 crop year, while almond market conditions have materially improved due to supply adjustments, though domestic demand remains soft. These broader market dynamics continue to influence acreage decisions statewide.

From a crop protection and long-term production standpoint, industry-funded programs remain a critical safeguard for California processing tomatoes. Both the Beet Curly Top Virus Control Board and the Broomrape Board play an important role in protecting supply continuity. Since its inception, the Broomrape Board has focused on processing tomatoes, with the potential to expand to other affected crops as needed. Curly top pressure remained very low during the 2025 season, supported by targeted preventative greenhouse practices in select regions with historically higher disease pressure. These early measures help protect young plants during the window before systemic protection is fully established in the field, complemented by ongoing monitoring and proactive response when thresholds are met.

The first year of the Broomrape initiative was considered successful. Voluntary compliance agreements – signed by growers, processors, and truckers – established clear, practical protocols for managing broomrape whether it is detected, suspected, or absent. Under this framework, fields with confirmed broomrape are no longer automatically quarantined and destroyed when proper sanitation practices are followed. Removing the threat of immediate quarantine has increased the likelihood of reporting, improving early detection and containment efforts. Because broomrape produces long-lived, easily spread seed, early identification and strict sanitation remain critical. This proactive, collaborative approach has been praised in regions where broomrape pressure has been most challenging. The Board continues to focus on prevention and eradication through collaboration, standardized protocols, research, and outreach – reinforcing confidence in the industry’s ability to manage risk while maintaining supply stability.

Looking ahead to 2026, contracted tonnage intentions are expected to decline modestly compared with initial 2025 intentions, as the industry works through elevated inventories following two consecutive strong production years in 2024 and 2025. Even with this adjustment, strong agronomic performance, proactive risk management, and coordinated industry oversight continue to support the long-term safety, reliability, and resilience of California processing tomato production.

###

Morning Star Newsletter now distributed electronically

As a reminder, Morning Star is now distributing our newsletters electronically using an email distribution vendor called Mailchimp. Your e-version will now include informative Morning Star videos and highlights. Depending on your company’s firewall, these emails may initially be directed to you spam folder.