WPTC Reports Increased Expected Volumes for 2023 Season

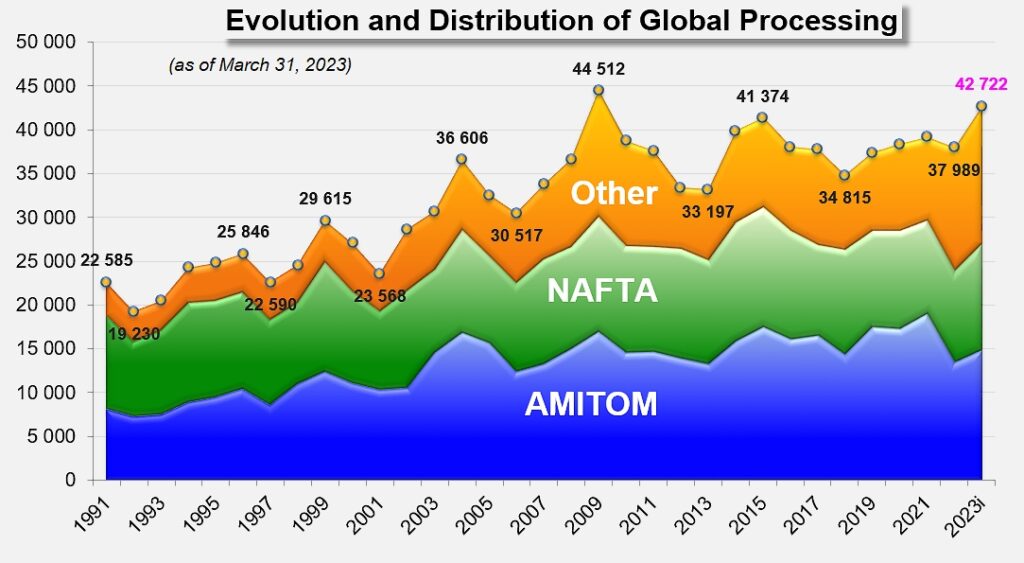

The World Processing Tomato Council, at the end of March, expects the global market to produce 42.758 million mT in 2023. This signifies a 4.770 million mT increase from 2022’s production of 37.988 million mT. Countries are currently in the planting stage of the season; therefore, better estimates will be available in June.

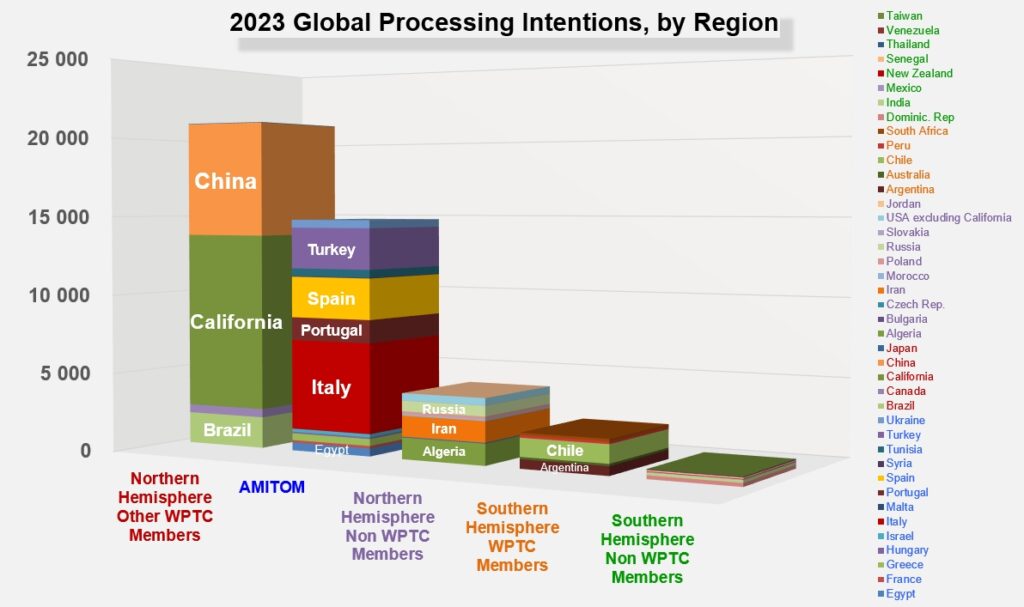

California and China production estimates account for 55% of the expected growth, adding 1.912 million mT and 1.213 million mT respectively. Other countries making notable increases in production estimates are Turkey, Brazil, and Ukraine. Turkey estimates 2.6 million mT, as their inventory of tomato products are waning and farmers have indicated a strong desire to plant tomatoes. Brazil increased planting surfaces by 9% and is expecting 1.99 million mT, signaling an estimated 22% increase from their 1.63 million mT in 2022.

Ukraine estimates 500,000 to 600,000 mT of tomatoes to be processed, with processors optimistic about their ability to plant despite the turmoil in the region. In the Mykolaiv region, a total of 240,000 hectares of land must be demined, with 19,000 of those hectares owned by Inagro, the largest processor. One of Inagro’s factories is in territory occupied by Russia and the other two have sustained damage, including 16,000 tonnes of paste having been destroyed. Transplanting started at the end of April.

Italy has planned an increase of 8% in surfaces, increasing their numbers in the South from 2.59 million mT to 2.8 million mT. Currently, planting in the South has been delayed due to cold weather and rain. The North expects to be on par with 2022 surfaces, despite weather causing damage due to frost, rain storms, and hail. Approximately 30% of the surfaces have been planted but weather is causing slower plant development.

Italian farmers are negotiating a price increase for raw tomatoes, with processors offering 130 euros/tonne and farmers asking for 155 euros/tonne. This price increase is unprecedented, with 2022 prices being 109.5/tonne which already was an 18% annual increase and a 40% increase over four years.

Spain estimates 2.6 million mT with planting underway in both Andalusia and Extremadura. With no significant weather delays, the regions are enjoying warm temperatures; however, with warm temperatures comes the drying of the fields and water allocations have been reduced. Water allocation is only at 60%, but it is an increase from 2022. Planting is scheduled to be finished in mid-May in Andalusia and end of May in Extremadura. Like Italy, Spain is facing high prices, the most recent price published in March was 150 euros/tonne.

China’s forecast remained steady at 7.3 million mT. While the estimate is based on seed sales, we do not yet know surfaces planted or the price of tomatoes in the region. In the first week of May, a dramatic snow event hit most of the Xinjiang growing region, where one third of the tomato crop had already been planted. The extent of the damage is not yet known, but will likely result in a significant reduction in Chinese processing tomato volumes.

Australia planted 1,503 hectares this season; however, some fields were lost to flooding. Significant rains caused delays and, compounded by the floods, could make for a very tough season. It is estimated that up to 1,000 hectares of ground have not yet been planted. Variable weather, from cool to hot, caused plants to slow in their growth. Episodes of hail also hit the region, decreasing yields and delaying growth.

As always, the beginning of the season is characterized by tomato price negotiations, inclement weather challenges, and water allocation restrictions. Overall, we expect to see some increase in the total amount of tomato paste processed this year versus 2022. With snow in China, flooding in California and drought in Spain, much of the planned increases will likely be muted and unable to make a meaningful surplus towards balancing inventories.

###

Morning Star Newsletter now distributed electronically

As a reminder, Morning Star is now distributing our newsletters electronically using an email distribution vendor called Mailchimp. Your e-version will now include informative Morning Star videos and highlights. Depending on your company’s firewall, these emails may initially be directed to you spam folder.