Key production trends and market forces influencing the 2026 crop year.

By: Jake Sherman

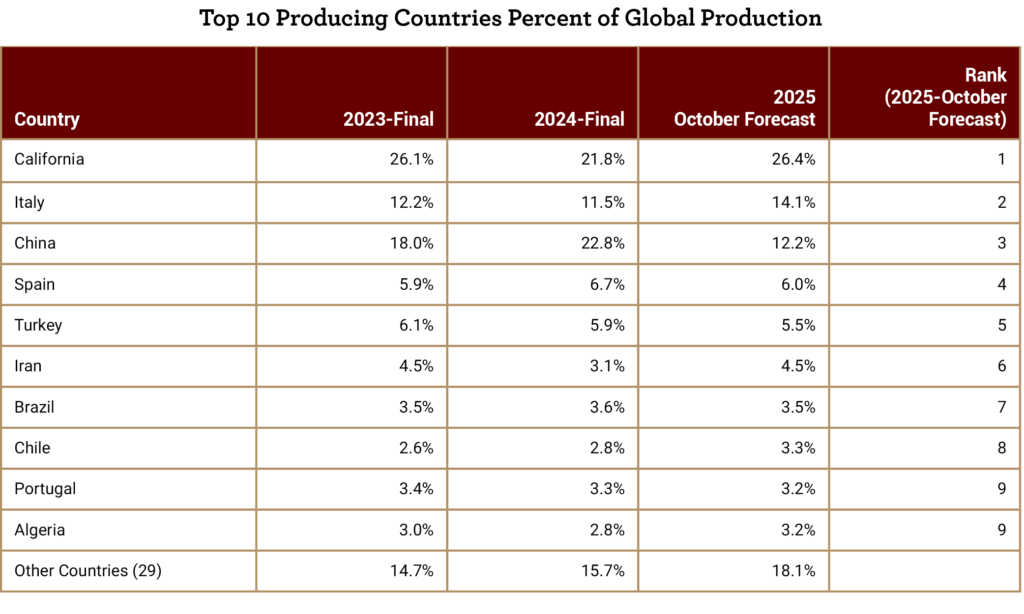

The global tomato processing industry experienced record-breaking production in 2023 and 2024, averaging 45.1 million metric tons annually. During this period, California accounted for an average of 23.9% of global production, China 20.4%, and Italy 11.8%, making them the three largest producing regions worldwide. In 2025, global production declined to 40.3 million metric tons, with California increasing its share to 26.4%, while China fell to 12.2% and Italy rose to 14.1%. While 2026 global estimates have not yet been released, elevated global inventory levels suggest production will likely remain near 2025 levels, or potentially slightly lower, as the market works toward rebalancing supply and demand.

China’s processing tomato industry is driven by low raw-product costs and the ability to export competitively to more than 200 countries. Exceptionally large production years in 2023 and 2024, combined with global export volumes flattening, particularly due to reduced shipments into the European Union following buyer pullbacks related to labor-rights concerns in the Xinjiang region, have led to elevated inventory levels. In response, China has offered very competitive pricing across global markets, displacing volumes from higher-cost producing countries that traditionally supplied those regions. Looking ahead, China is likely to produce volumes similar to 2025 levels and may continue to expand its network of trading partners, supported by its low-cost structure, relatively weak currency, and improving baseline product quality.

Italy’s processing tomato industry is anchored in its “Made in Italy” strategy, which functions as a premium-value model and has been successful in export markets such as North America and other high-income regions. However, Italy faces some of the highest production costs globally and, like other European Union producers, operates under strict regulations governing labor, pesticides, fertilizers, and emissions, all of which raise costs relative to global competitors. Italy’s export performance softened in 2025, largely due to higher U.S. tariffs and an increasingly competitive global market for processed tomato products. As a result, Italy is likely to maintain production near 2025 levels while focusing on protecting brand value and avoiding being priced out of increasingly price-sensitive international markets.

California’s processing tomato industry is driven by scale efficiencies and yield performance. The 2025 season delivered exceptional yields, with average yield per acre approximately 10% higher than historical levels. This resulted in roughly one million additional tons of production with minimal acreage expansion, largely due to improved varieties and favorable growing conditions. Higher yields lowered per-ton production costs, which improved California’s competitiveness in export markets. Exports to Canada and Mexico have remained relatively stable, suggesting that future export growth will need to come from markets outside of NAFTA, where elevated global inventories are creating a highly competitive environment. To support longer-term growth, California is likely to reduce production from 2025 levels to help draw down inventories, while continuing to expand exports beyond NAFTA in order to sustain demand and justify increased acreage in future seasons.

###

Morning Star Newsletter now distributed electronically

As a reminder, Morning Star is now distributing our newsletters electronically using an email distribution vendor called Mailchimp. Your e-version will now include informative Morning Star videos and highlights. Depending on your company’s firewall, these emails may initially be directed to you spam folder.