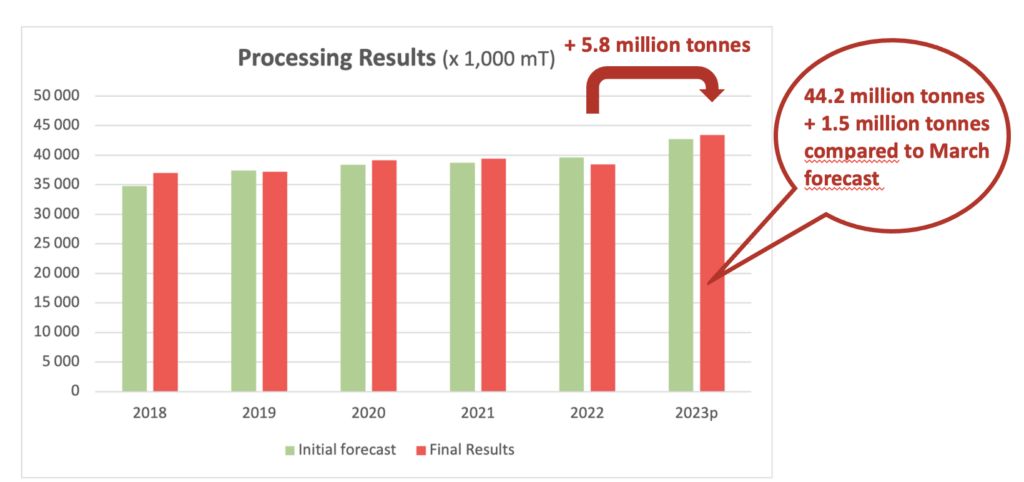

Global Production Exceeds Expectations. Processors Around the World Produce 44.2 Million mT.

Despite the inevitable challenges of rain, heat, disease, and political conflicts, the global tomato industry managed to outpace the initial forecast of 42.7 million mT by 1.5 million mT, representing a 5.8 million mT increase from the 2022 crop. Outside of California’s 11.5 million mT, Italy and China represented the largest production regions in 2022. Despite record prices for raw product, global production was not slowed in 2023.

Source:WPTC/Tomato News

Italy’s production wrapped up its season with 5.4 million mT, nearly on par with 2022 levels. Like California, Italy was challenged with an extended processing period, pushing production into November. Production costs represent a significant challenge for the season and look to be a continuing stressor in the future. Extreme weather, which forced factory shutdowns, occurred more than in recent years. Italy was able to process 2.8 million mT in the North and 2.6 million mT in the Central and Southern regions. While surfaces planted had increased by 5% in the Central and Southern regions, production was on par with 2022 levels due to yield reductions.

Total processing volume in China reached 8 million mT, with their season being pushed a week longer than usual. Early forecasts of 7.3 million mT, already an increase from 2022’s 6.2 million mT, were exceeded by 700,000 mT. 4.78 million mT were processed in Northern Xinjiang, 1.6 million mT in Southern Xinjiang, 0.08 million mT in Gansu and Ningxia, and 1.51 million mT in Inner Mongolia. China employed 10 more factories in 2023, with total processing facilities reaching 100. Processing capacity was increased by 20% compared to 2022. China was not free of challenges; however, with surprising snowfall in the spring, extreme heat in early plant development, decreased yields, and extended transportation distances plaguing their 2023 season. China also had to contend with increased costs of raw material and production costs. Demand for raw material saw an increase in 2023, driving costs higher than 2022.

Portugal concluded its season with 1.5 million mT. Crops were challenged with low yields early in the season and heat, frost, and rain during the season. Turkey experienced a long season, with final production at 2.7 million mT, on par with their initial forecast. Ukraine, despite the conflict in regions throughout the country, produced 500,000 mT. France reduced its production slightly and finished with volumes of almost 160,000. Greece suffered from rain and floods, reducing their volume by 15% to 390,000 mT.

Spain expected to produce 2.7 million mT but was challenged by rain during harvesting in September, leading to lower yields. Production was 2.6 million mT. Extremadura experienced a long season, as did most of the global processing regions, ending on October 10th. Andalusia suffered from reduced access to water, reducing surfaces harvested. Increased temperatures contributed to its reduction in production.

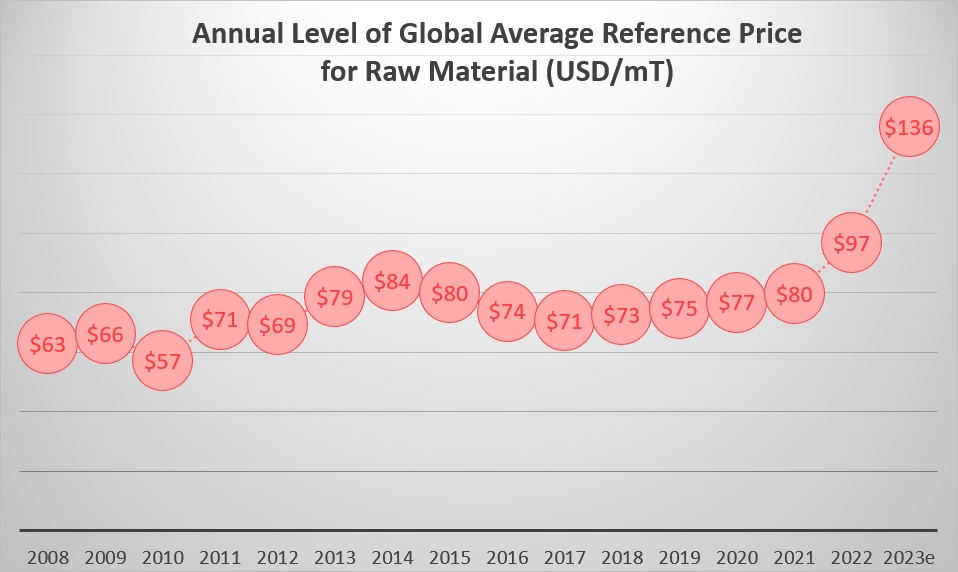

The global processing environment for 2024 is expected to continue experiencing rises in production costs. 2023 raw material costs were 40% higher than 2022 prices, which were already a record level for raw material in its own right (2022 had a 60% higher than the average price from 2020 to 2022). Processors around the world will have to contend with these astronomical increases in production costs, as raw tomatoes represent the majority of input costs to the processors. The Director of ANICAV (the National Association of Industrial Vegetable Food Preserves), Giovanni De Angelis, says, “Finding an agreement on the average reference price of the raw material is increasingly difficult. A new supply chain relationship is necessary and we will discuss it during the next public meeting of the ANICAV, Il Filo Rosso del Pomodoro, scheduled for November 24th.” The outcome of that meeting and any resolutions have yet to be published, but we expect this conversation around raw material prices to be at the forefront of processors’ minds around the world, from California to China to Italy and beyond.

Source:WPTC/Tomato News

###

Morning Star Newsletter now distributed electronically

As a reminder, Morning Star is now distributing our newsletters electronically using an email distribution vendor called Mailchimp. Your e-version will now include informative Morning Star videos and highlights. Depending on your company’s firewall, these emails may initially be directed to you spam folder.